Whenever someone wins one of those big-ticket hole-in-one prizes, a niche insurance company has to foot the bill. Don’t worry, though; they’re still making money on the deal.

Making a hole-in-one isn’t what it used to be. Just ask Eric D., who pocketed a cool million with one swing during a charity event at Piñon Hills Golf Course in New Mexico. Or Howard B., who did the same at Middle Island Country Club in New York.

Scoring an ace used to mean a few minutes of giddy exuberance followed by the sobering reality of a monstrous bar bill in the clubhouse. Eric and Howard didn’t have to worry about covering their tabs. But what about the event organizers? Were they on the hook for paying out all that cash?

Hardly.

Since the early 1990s, golf-event organizers—including the tournament directors of professional golf events—have been able to buy hole-in-one (HIO) insurance. These policies protect them from having to cover the cost of the new cars, trips to Hawaii, and big cash prizes dangled in front of players at their outings. In the decades since, this kind of insurance has become big business, with a bumper crop of companies emerging that specialize in it. And for good reason: It’s profitable.

According to the National Hole-in-One Registry, the odds of an average player making an ace are low—about 12,000 to one. So, chances are, most of the money paid to insure against these freak occurrences will go straight into the insurers’ bank accounts, soon to be joined by more. That said, the Registry also reports that a significant number of aces are made every year—more than 128,000 in the U.S. alone. And since no event director wants to risk getting stuck with the bill for a shiny new Lexus when you hit your shot of a lifetime, they avail themselves of the services that these HIO insurers happily provide.

One of the oldest and largest companies in this space is Hole-in-One International, a Reno-based outfit that opened its doors in 1991 when three college-golf teammates (including PGA Tour Champions player Kirk Triplett) saw an opportunity to build a business around aces. In an average year, they insure between 12,000 and 13,000 HIO contests. All told, since the day the business opened, they’ve handed out more than $56,000,000 in cash and prizes—including six prizes of $1,000,000 each.

Mark Gilmartin, president of the company, says that pricing for these insurance policies is based on three factors: the length of the hole, the number of players taking a shot at it, and the value of the prize. Input those variables into an actuarial algorithm and out pops the odds of someone actually succeeding, which the insurer then uses to establish the premium.

Take this example: If you wanted to offer a $50,000 Mercedes as a prize on a 175-yard hole and give 90 players a chance to win it, Hole-in-One International would price that coverage at $920. Not a ton of money considering the value of the vehicle. Should someone win the car, don’t shed too many tears for the insurer, because the money wouldn’t actually come out of its pocket. The coverage these insurers sell is almost always underwritten by another insurance company. So, their bets are covered. But none of that matters to the winners, who, Gilmartin reports, have won “everything you can imagine” in the years since their business kicked off.

ACES WILD

Some unusual Hole-in-One prizes offered at amateur or professional events

Lamborghini Huracán

Private-Jet Flight Credits

Full Barrel Of Jack Daniels Whiskey

A $100,000 Hearse

Polaris All-Terrain Vehicle

NFL Season Tickets

30,000 CHF (Swiss Francs) In Life Insurance

Rolex Yachtmaster

168 Bottles Of Vintage Champagne

Mount Everest Expedition

Boston Whaler Boat & Trailer

Year’s Supply Of Warsteiner Beer

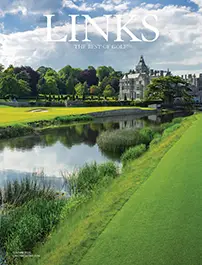

A House At Gleneagles

John Deere Gator Utility Vehicle

Aston Martin Vantage

An Ornate Moroccan Lamp

A Volvo Excavator

Luxury Townhouse In Thailand

Catered Korean Food Event Valued At $50,000

An Iberico Ham

Steve Fournier, President of New Hampshire-based Nationwide Hole-in-One, encourages event organizers to get creative about the prizes they offer in order to create buzz about their events. Along with the usual cars and trips and watches, Fournier’s clients have tantalized their event attendees with everything from Airstream RVs and new homes to a Mount Everest expedition offered as a prize during a tournament for mountaineers.

“There’s all different kinds of things people do,” says Fournier. “If they can dream it up, we can insure it.” Take the Kids Matter International charity tournament called Eagles Challenge at Timarron Country Club in Texas, which features 18 holes shortened to par-three lengths. On each hole, players have the opportunity to walk away with 50 grand—and two players have cashed in. At an event promoting a new private-club community in Rhode Island, participants had the chance to win $1 million on every one of its course’s 18 par-three holes. The Nationwide policy for that event cost the organizer over $80,000, but in that case (sadly for the players, not for Nationwide) no checks needed to be written.

There are rules to these contests, of course. Every ace must be properly witnessed—and the verification requirements generally increase in proportion to the value of the prize. Larger prizes usually require video evidence. Occasionally, organizers will mistakenly set up a hole at a shorter distance than their insurance coverage allows. That happened at The Greenbrier Classic in 2015. The policy there dictated that the hole in question (the 18th) needed to play 150 yards or longer; instead, it was set up at 137. The insurer denied the resulting claim and the courts supported that decision. At another recent event in Arkansas, the host club never got around to buying insurance for the 2022 Ford F-150 they said they’d give to the first person making an ace, and, of course, someone made one. It’s still TBD on how that will play out, but it could prove to be an expensive mistake.

Outright attempts to cheat in HIO contests are rare, though not unheard of. With fellow players around, plus myriad other witnesses—and, in most cases, a head pro who needs to sign an affidavit—you’d need to organize a pretty big conspiracy to advance a false hole-in-one claim. But with all this money at stake, it will come as no surprise that scammers have sometimes looked to get in on the act.

Kevin Kolenda of Norwalk, Conn., was twice convicted in Washington State of theft and insurance fraud for selling HIO insurance without a license through a website he’d set up. He’d sell the insurance, then not pay claims. Following his first conviction, investigators said that Kolenda was right back at it just four days after getting out of jail. In his second trial, he was sentenced to 15 months in prison plus restitution, repayment of extradition costs, and fees totaling more than $25,000—the same amount he’d reportedly refused to pay out for some of the legitimate holes-in-one he’d accepted payments to cover.

Finally, although you might think otherwise, winning a big HIO prize isn’t always a bed of roses. One high-value prize winner, who wishes to remain anonymous, explains: “The first time I got a hole-in-one, it cost me three hundred bucks in the bar. The second time, I got a big, fat check. But then people came out of the woodwork, and they were looking for a lot more than just free drinks. So please don’t mention my name in your story!”