By Bob Dagley

Scotland, Portugal, Mexico, Spain, the Caribbean. These destinations’ siren calls have been luring American golfers to their exotic shores and high-profile courses for decades. And those who fall in love with the local lifestyles often dream of owning a home overseas. It’s doable, but understand from the start that there can be as many pitfalls as joys in owning your getaway across the ocean or across the border. To help ensure your dream golf home abroad doesn’t become a nightmare, these 10 essential tips will help you stay on course. But they are just the beginning: Each overseas destination has its own peculiarities.

1. Do Your Homework

This almost goes without saying, but many problems have been caused by excited—and inexperienced—buyers drawn in by the allure of a foreign destination and then making a rash decision without due diligence. A seven-day vacation at an overseas golf resort might give you a taste of life there, but it won’t come close to answering the very important questions that affect home purchase and ownership, stability of a region, annual costs, year-round weather, and how it is living there when you’re not in vacation mode. Buying a home overseas is largely unregulated and often nothing like buying in the U.S. It can’t be stressed enough that you need to do research—online and in person—talk to others who have bought overseas, and ask questions. Lots of them.

2. Spend Some Time Living There

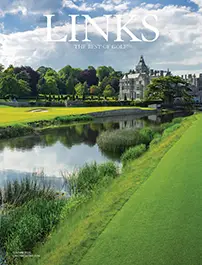

One of the best ways to get your homework done is to actually try living where you want to buy. LINKS Magazine Editor George Peper knows firsthand what it takes to buy, renovate, and live overseas. He and wife Libby purchased a townhouse alongside the 18th hole of the Old Course at St. Andrews. “Our experience living in St. Andrews for seven years turned out to be a home run,” says Peper, “but we were lucky, being able to buy before prices got crazy and visit our flat several times before taking the leap to live there. You need to spend some time living where you want to buy—and not just a week or two. Get a feel for the way of life, the day-to-day character and rhythm of the place. And maybe the most important thing: Wherever you’re headed, it helps greatly to have at least one friend already in residence.”

3. Know The Seller

At Trump International Doonbeg in Ireland, name recognition for the developer is not a problem. But Brendan Murphy, the club’s Director of Real Estate, Private Club Membership says that knowing and trusting the seller is one of the most important considerations when buying overseas. “If the owner is well known for success, then you know you are at the right place,” says Murphy, who believes that when you “buy into a great brand, the rest will take care of itself.” He suggests meeting or phoning management directly to ask all the hard questions, then gauge their passion for the club or development, and make sure you are comfortable to move forward.

4. Always Use An Independent Attorney

The UK-based Association of International Property Professionals (AIPP), which publishes a comprehensive guide to buying overseas (see sidebar), says if you take away only one piece of advice from them it should be to use your own lawyer (not the developer’s or real estate agent’s) when buying overseas—and never, ever sign a sales contract or mortgage agreement without having it checked by your own lawyer. According to the AIPP, “A multitude of problems can usually be avoided by doing this one thing, even though it might cost a little extra, the expense might provide priceless peace of mind—and spare you far greater financial losses somewhere down the line.” Enrique Gandara, Vice President, Sales and Marketing, of Pueblo Bonito Resorts and Spas in Mexico, which, among other properties, manages Quivira in Cabo San Lucas, recommends that buyers looking in Mexico work with an in-country broker to help them better understand the ins and outs of real estate investment. That’s good advice no matter where you buy.

5. Cash Is King

According to the AAIP, 59% of overseas buyers pay cash. Which makes sense because as a general rule, buying property abroad is easier (and sometimes the only available option) as a cash transaction. Otherwise, you will need to navigate a maze of country-specific financing rules. If you do go the mortgage route, expect to pay a larger down payment and a higher interest rate than you would in the U.S., with a shorter repayment schedule. For example, in the Caribbean, minimum down payments often range from 30% to 40% and loans generally need to be repaid in 15 to 25 years, reports The Wall Street Journal.

6. Get A Clear Title

“The most important thing to me is ‘Property Rights,’” says William Holden, Broker-Owner of Holden Sotheby’s International Realty, who specializes in private communities in the Caribbean. “In other words, is foreign ownership welcome, and, in turn, will there be clear title if a purchase is made. In the Dominican Republic, there is good news: Property rights are respected, and in fact, there are many similarities to the United States.” However, he cautions, in the DR “smart money only goes after properties with a deslinde, which is the highest form of clear title.”

7. Know The Other Costs Involved

“No matter how well you may think you know and love the area, do your homework on the unromantic aspects of buying and living there,” advises Peper. Investigate the cost of living and general economic outlook of the area, and get the facts on real estate closing costs, local taxes, and health care costs (more on that later). In Mexico, for example, Gandara says, “there will be fees of around 5% of property value to be paid upon the completion of the transaction, which covers fees and taxes for the first year. After that, the owner will have to pay property taxes and fideicomiso (escrow), which can be up to 2%.” In Scotland, they use a sliding scale, which can be as high as 12%, to determine the Land and Buildings Transaction Tax.

8. Check Visitation Rights

Unless you are ready to renounce your U.S. citizenship (Forbes reports that more Americans gave up their U.S. citizenship in 2014 than ever before), your new home country may limit how many months a year you can be there. The requirements vary by country, so check your particular destination. If you own a home in Canada, Rob McLeese, president of Cobble Beach in Ontario, suggests looking into a Global Entry pass, a U.S. Customs and Border Protection (CBP) program that simplifies border crossing into and out of Canada. You must be pre-approved for the program, which entails a rigorous background check and in-person interview.

9. Health Care Conundrum

Many private golf communities in the U.S. tout easy accessibility to world-class healthcare. Things are very different when you live a world apart from familiar providers. If you rely on Medicare, be aware that the U.S. Department of State advises that the program does not provide coverage for hospital or medical costs outside of the United States. Before committing to living overseas, check your health-care policy to be sure you are covered out of the U.S.

10. Patience, Patience, Patience

When JP & Sylvia Tremblay purchased a new condo in Mexico’s Baja region, their experience buying in both the U.S. and Canada gave them certain expectations, like expedited processes, that they did not find true in Mexico. “[In Mexico] there are many more steps and each step seems to require another appointment so the entire process was longer than what we were used to,” says JP. “We moved into our new condo in mid-September

Be sure to have a host country Will drawn up by a local Attorney.